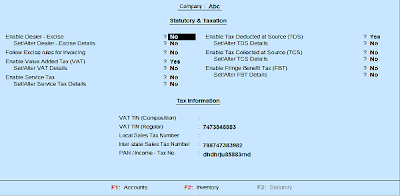

For calculating VAT, first of all changes in statutory and taxation. It is the main company features.on the other hand, For impose a VAT. click on features which are shown on the right hand on the screen. Then click on statutory and taxation. For VAT, only one option is changed. This is (enable Value added Tax). And also tax information is necessary like VAT TIN, local sales tax no., inter sales tax no., PAN income tax no. Then again go on create ledger and impose vat on five items.

- PRESS F 11 --> COMPANY FEATURES --> F3

- F3 --> STATUTORY AND TAXATION

- STATUTORY AND TAXATION --> ACTIVATE ENABLE VALUE ADDED TAX

For impose vat:

Gateway of tally --> account info. --> Single ledger --> create.

How vat is calculated in tally?

After the ledger creation vat is calculated. Vat is imposed only five items. Vat can be calculated only those circumstances when person had business related to trading like sales, purchase, etc. Now at time vat rate is 5.5%.

- Sales 5.5%

- Purchase5.5%

- Input vat 5.5%

- Output vat 5.5%

- Surcharge 5.5%

When any transactions is done in tally accept is very necessary otherwise data is not saved.

- Sales 5.5%: in sales 5.5% under sales account. And accept it.

- Purchases 5.5%: in purchases5.5% under purchase account. And accept it.

- Input vat 5.5%: it’s imposed under duties and taxes.

- Types: various options are opened but we will select only one option like others

- Inventory value are effected: no

- Percentage of calculation: when vat 5.5% then input vat only 5% because .5% including surcharge. It is imposed on total sale.

- Output vat 5.5%: it’s imposed under duties and taxes.

- Types: various options are opened but we will select only one option like others.

- Inventory value are effected: no

- Percentage of calculation: when vat 5.5% then output vat only 5% because .5% including surcharge. It is imposed on total sale.

- Surcharge on vat 5.5%: it’s imposed under duties and taxes.

- Types: various options are opened but we will select only one option like others.

- Inventory value are effected: no

- Percentage of calculation: when vat 5.5% then surcharge vat only .5%. It is imposed on total sale.